What are the salary scales for work-study programs?

On August 1, 2022, the increase in the minimum wage in a context of inflation will lead to an increase in the legal minimum wage for work-study programs. It is not always easy to keep up with the regulations on the salary scale, especially since there are specificities for each age group, depending on the degree and the type of work-study contract. What are the current legal minimums? How are they calculated? Whether you are a recruiter or a tutor, here we give you all the details you need to know before signing an apprenticeship contract.

How is an apprentice's salary calculated?

By hiring an apprentice, you are committing yourself to providing him/her with professional training, provided by both your organization and an apprenticeship program or apprentice training center, and to paying him/her a salary (from the beginning to the end of the contract). You can choose between an apprenticeship or professionalization contract.

For the apprenticeship contract

The salary is calculated on the basis of the gross monthly minimum wage or on the conventional minimum wage provided for in your organization's collective agreement. It then varies according to

the age of the student

his/her diploma/level of study

the number of years of the contract

If the apprentice shares his/her work time between several employers, the rate of pay is calculated according to the number of hours worked in your company. For overtime, the procedures for compensation are the same as those applied to workers in the company.

The minimum gross salary in 2022

In 2022, here are the minimum monthly salary bases for the remuneration of an apprentice in a work-study contract in the private sector:

* in percentage based on the value of the smic or on the conventional minimum wage (SMC) if existing.

For the professionalization contract

As with the apprenticeship contract, the salary for a professionalization contract is calculated as a percentage of the minimum wage. This time, it differs according to 2 parameters

the apprentice's age

the apprentice's level of qualification (diploma below baccalaureate level or level equivalent to or above baccalaureate pro).

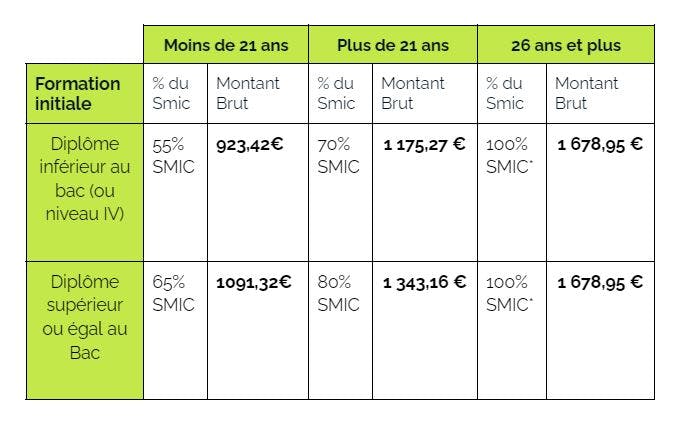

The minimum gross salary in 2022

Since August 2022, for each new professionalization contract, the revaluation of the minimum wage has also led to an increase in salary.

Here is the legal minimum monthly amount by age and level of study:

* in percentage based on the value of the smic or on the conventional minimum wage (SMC) if existing.

Beyond the legal minimum...

⚠️Proposing remuneration that is more advantageous than the legal minimum is of course not prohibited. You are free to set your own salary scale for alternating apprenticeship or professionalization contracts!

Benefits in kind

If you offer benefits in kind (housing, food), you can also deduct from your apprentices' pay for these benefits, as long as they are included in the contract and up to 75% of the minimum wage.

Increase in the apprentice's salary

When the age bracket changesWhen your apprentice changes age bracket (18, 21 or 26) during the year, the salary changes on the first day of the month following his or her birthday (for example: for an apprentice born on April 13, the salary will change on May 1).

In case of reduced training durationSometimes, the professional experience in an apprenticeship is shorter than that of a regular training cycle. According to article D.6222-28-1 of the French labor code, this does not have an impact on the evaluation of the salary. For example, an apprentice in Master 2 will be paid on the basis of a 2nd year of execution of the contract.

In the event of a succession of apprenticeship contractsIn the event of a succession of apprenticeship contracts by an apprentice, his or her remuneration must at least be equal to the last salary received in the last year of his or her previous contract, when the latter led to the award of the title or diploma prepared.

And article D6222-30 of the French Labor Code specifies that in the event of a succession of contracts, the percentage of remuneration - based on the SMIC or the conventional minimum wage - of the apprentice is increased by 15 points in the event that these 3 conditions are met:

-> The duration of the apprenticeship contract is less than or equal to 1 year

-> The apprentice is preparing for a diploma or qualification at the same level as a previously obtained diploma or qualification

-> The professional qualification sought is directly related to that resulting from the diploma or title previously obtained

Social charges and contributions for work-study contracts

Since January 1, 2019, the exemptions from employer and employee social charges for professionalization contracts and employer contributions for apprenticeship contracts have been eliminated.

The apprenticeship contract retains a total exemption from employee contributions for the portion of the salary not exceeding 79% of the Smic. Beyond that, the portion of the salary remains subject to contributions based on the actual amount of the salary.

For the rest, the two contracts now benefit from the system applicable to all employment contracts for a general and reinforced reduction in social security contributions.

Some special cases!

Apprentices in the non-industrial and commercial public sector can benefit from an increase if :

the apprentice is preparing a level IV diploma: 10% increase

the apprentice is preparing a level III diploma: 20% increase

Apprentices who are minors must receive at least a quarter of their salary from their employer.

An apprentice who is recognized as a disabled worker can complete an additional year of work-study and the salary is increased by 15%.

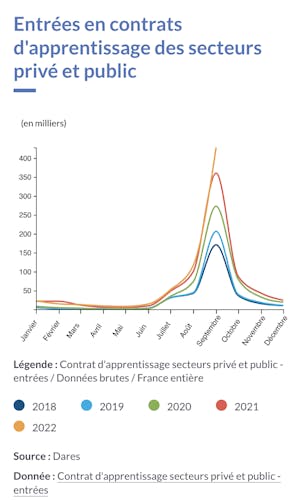

Dates for apprenticeship contracts

Financial aid for work-study programs

For apprenticeship and professionalization contracts

⚠️ Until December 31, 2022, as part of the "1 young person, 1 solution" plan, the government has set up aid for the recruitment of apprentices under 30 years of age, for all contracts concluded between July 1, 2020 and December 31, 2022, up to master's level and for all companies!

The amount of compensation?

5,000 euros maximum for young people under the age of 18

8,000 euros maximum for an apprentice over 18

For professionalization contracts only

There are also other grants for hiring :

job seekers aged 30 and over

disabled people

Contracts in the IAE integration pathway, signed from January 1, 2021 onwards

long-term unemployed people

For further

👉10 tips for effective recruiting?

👉The complete guide to successful impact recruiting